This question can sound simple and naive but in fact it represents the main issue you will meet as a profitable trader.

A lot of traders around there are focusing on winning and earning money when they build their system. Another interesting approach is to reverse this point of view and taking your system by the losing side.

As you should know, the main difficulty in the profitable trader journey is the psychology aspect, not the technical one. Finding good technical entries to have an edge on the Forex market is child’s play with little experience. Even systems based on pseudo-random Market entries could be profitable (Google “3ATR Linda Raschke”). However, dealing with your deep psychological biais over the time is fucking hard.

When you are building and testing your trading system, the psychological issues can take many forms. The hardest thing to solve is your endurance to the drawdowns you will face in your trader life. It will melt your brain, make lose your confidence, make lose your bearings. Pure hapiness !

When you see your money burning trade after trade, you’ll become upset of course but you will lose your bearings too. It will make you lose money even faster. Being well armed against drawdowns in the Forex world is not an option. If you want to be successful, you have to deal with it and accept it. Depending on your trading system characteristics and properties, it can be easier to accept.

The expected Drawdown depends on your System properties

Here comes my crappy & ugly Drawdown simulator. You can find it here and you can play to understand what I mean.

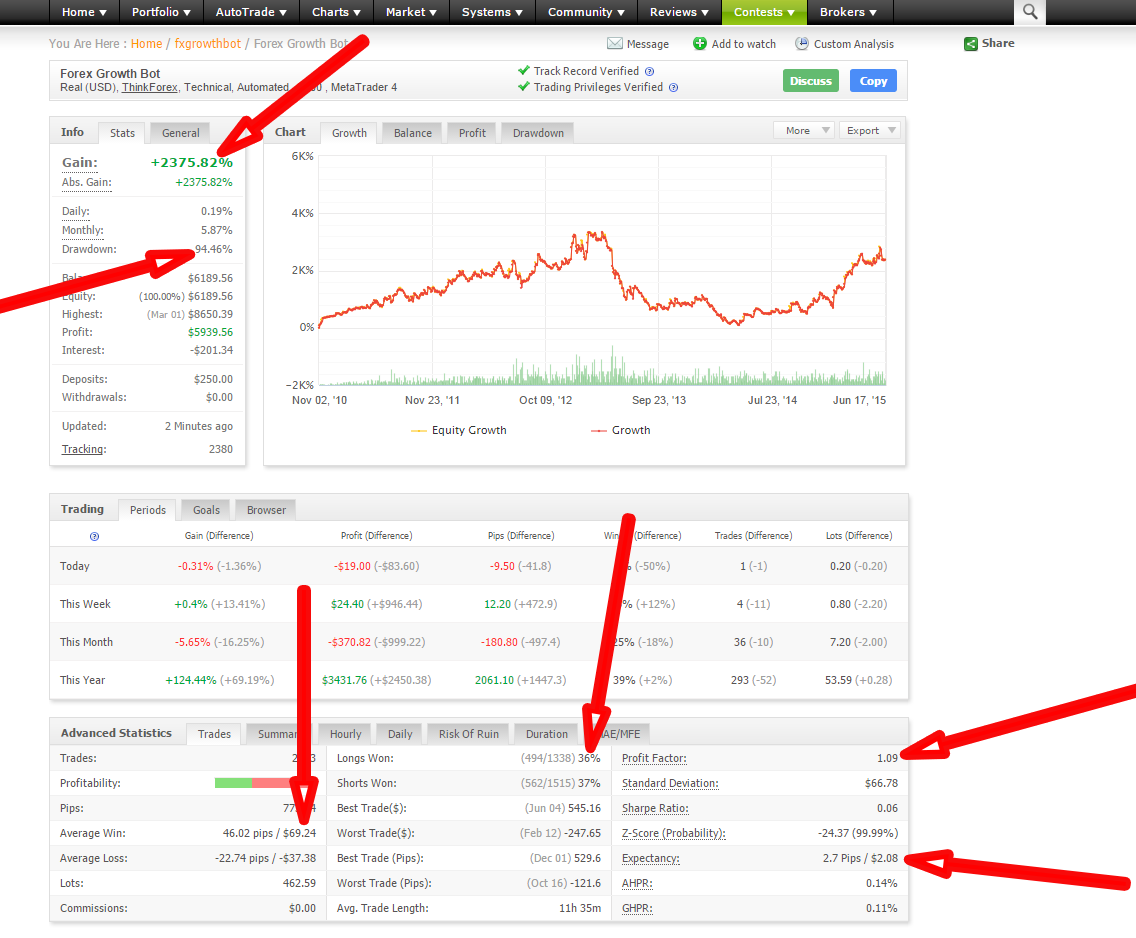

Every trading systems have their own properties and characteristics, like Winratio, Max Drawdown, Risk per trade, Money management, … You can have a good overview of these when you look at random systems on MyFxBook websites. Here is a almost randomly chosen trading system (it’s the rank 1. trading system…) on Myfxbook :

I highlighted the interesting properties of this trading system with the red arrows. If we put aside the fact that this trading system is a massive shitstorm, we can see the Winratio really low, the Drawdown really high (in fact it can’t be worse…), the low expectancy, …

I highlighted the interesting properties of this trading system with the red arrows. If we put aside the fact that this trading system is a massive shitstorm, we can see the Winratio really low, the Drawdown really high (in fact it can’t be worse…), the low expectancy, …

It’s critical to understand that the drawdowns of a trading system are directly linked with its properties. The winratio is one this critical property.

Lower the winratio will be, more unbearable your drawdowns will be.

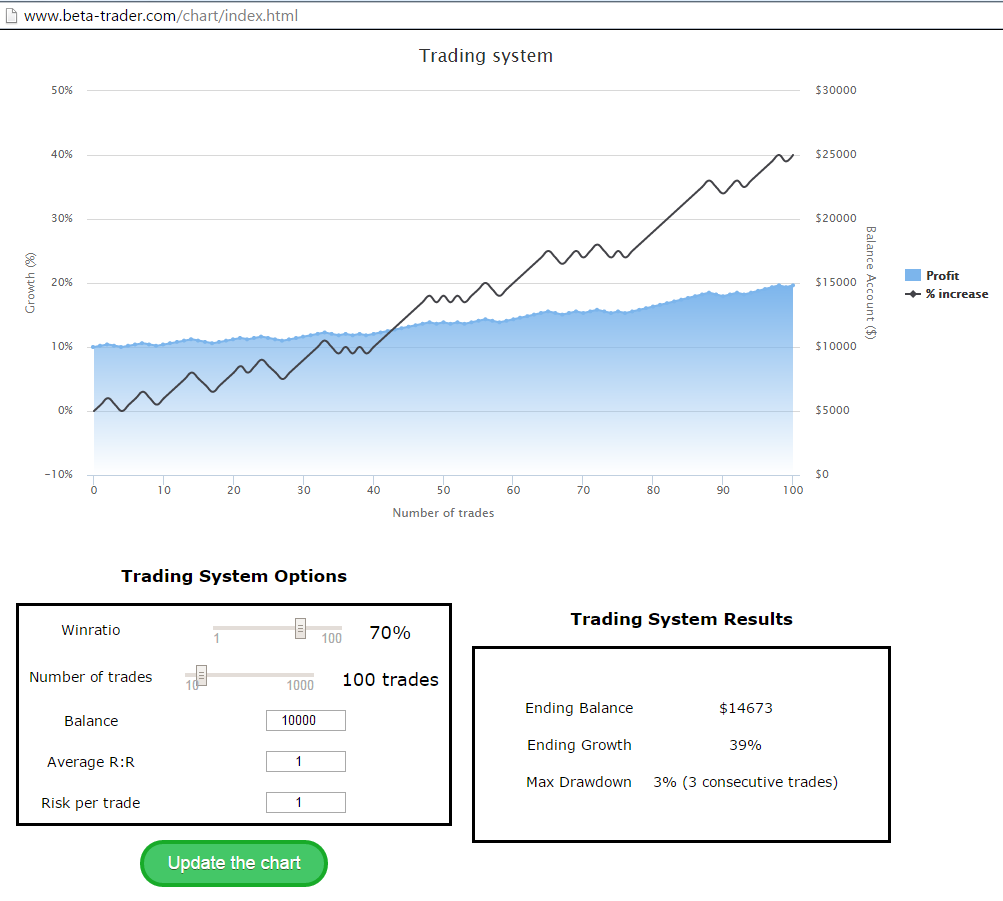

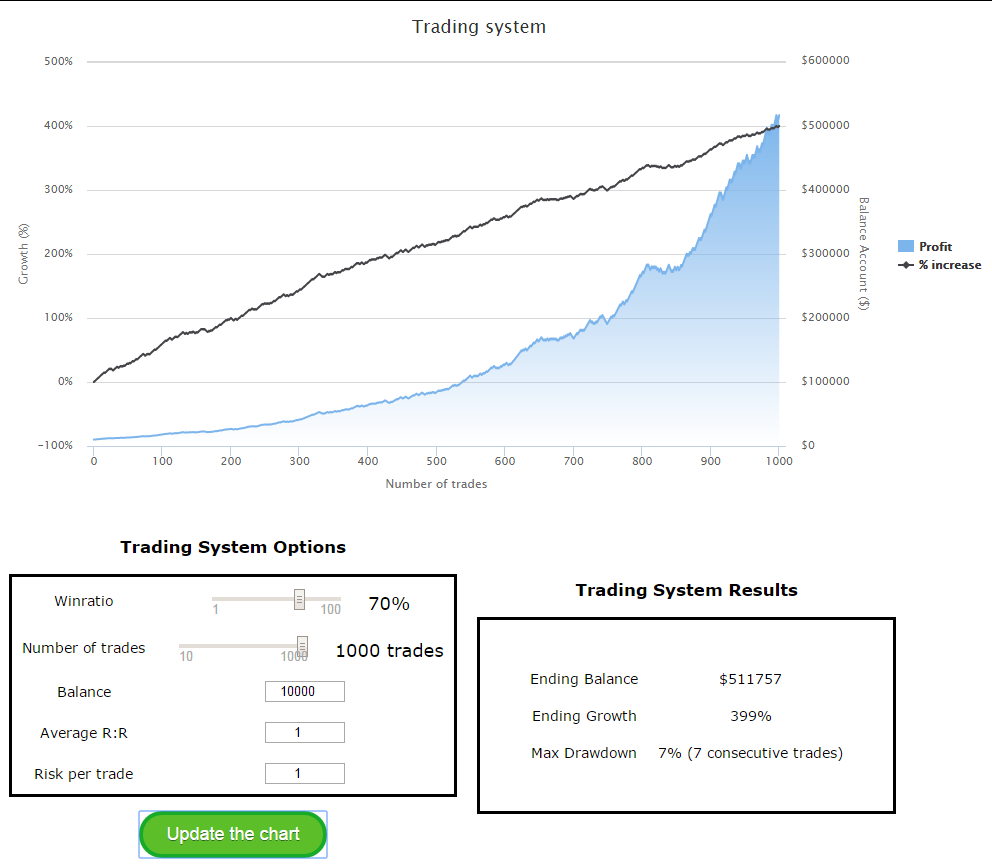

Now I will take examples with my Drawdown simulator. We can assume, we have a system with a 70% winratio, with an easy 1:1 average R:R and 1% risk per trade :

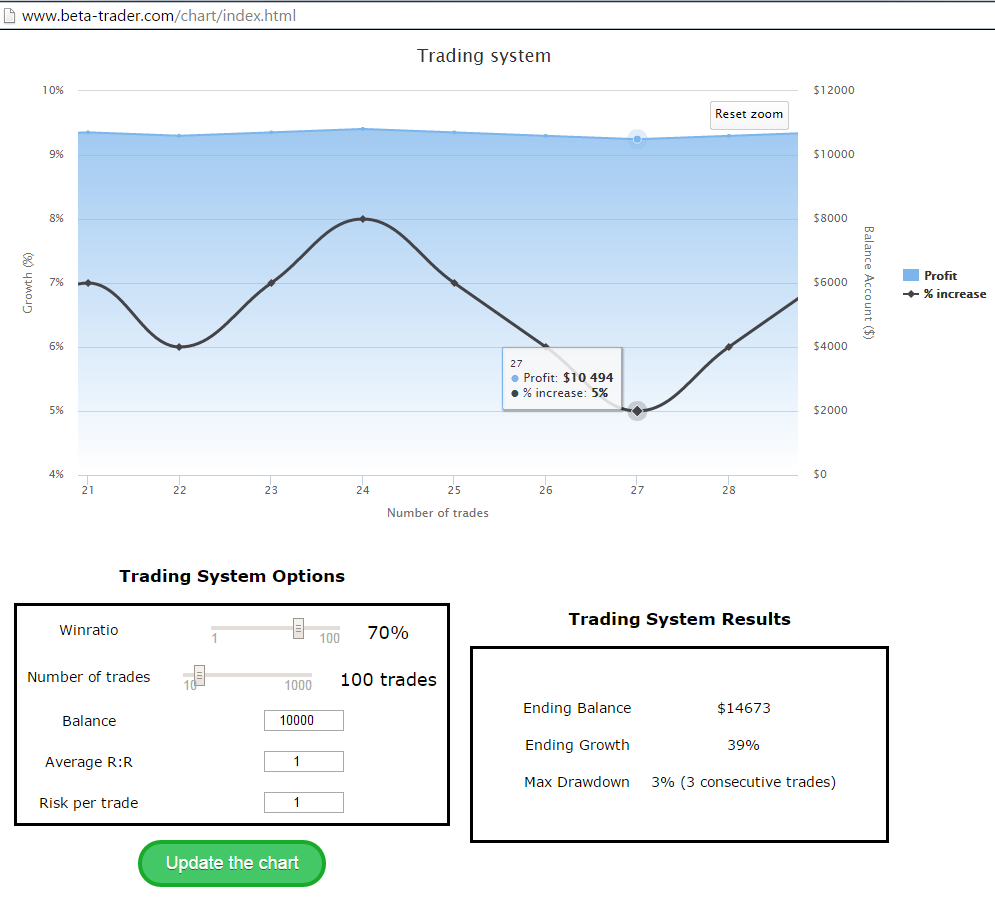

Above, we can see that we make money because our winratio is higher than 50% and the system risks 1% per trade with 1% average expectancy. After 100 trades, we made $4673 with a max drawdown of 3%, because of 3 consecutive losing trades. This drawdown is logical and in the mean of the system because the winratio is 70%. We can zoom on this drawdown period to see it more accuratly :

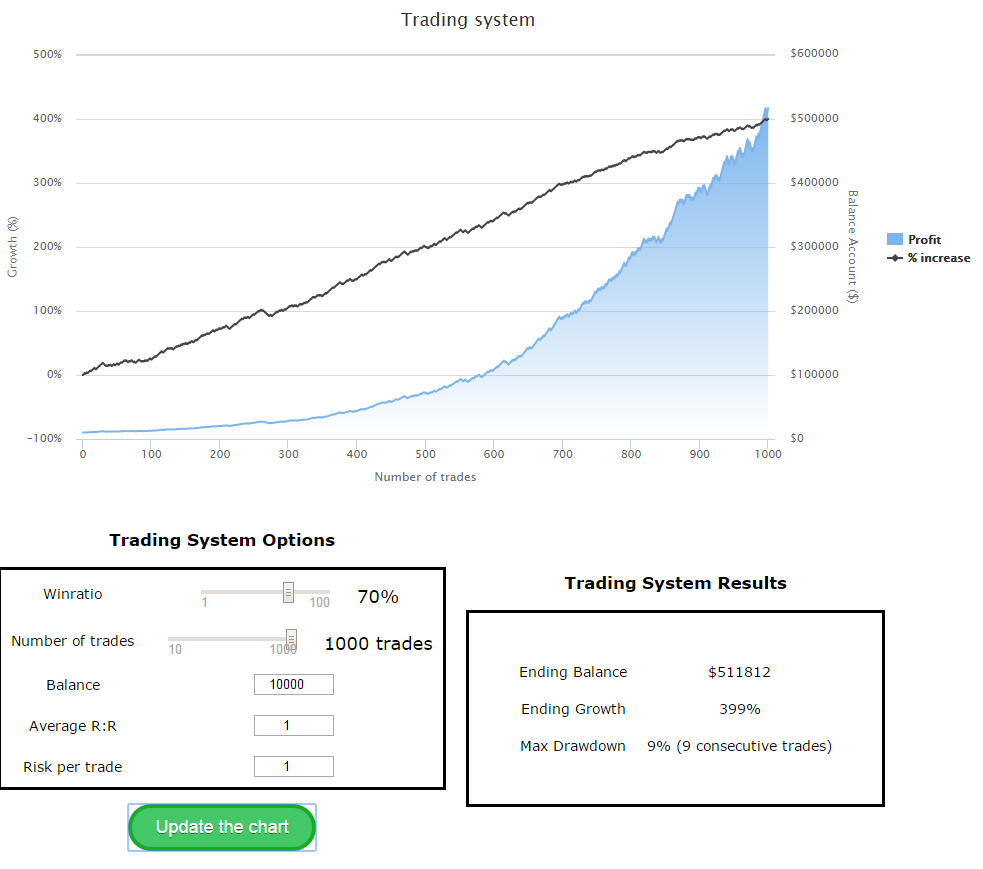

Since this system has pretty good statistic, we can say that enduring 3% of drawdown is not so hard. I agree. Now, we use the exact same properties for this system but we take 1000 trades:

This time, it’s different. We have a Max drawdown of 9% because of 9 consecutive losing trades. It could become harder to endure… But wait… Why this good system with 70% Winratio can have a such big drawdowns ???

The answer is pretty easy : It depends on your losing streak. You will never be able to forecast your losing trades streak and your drawdowns. This is pure randomness.

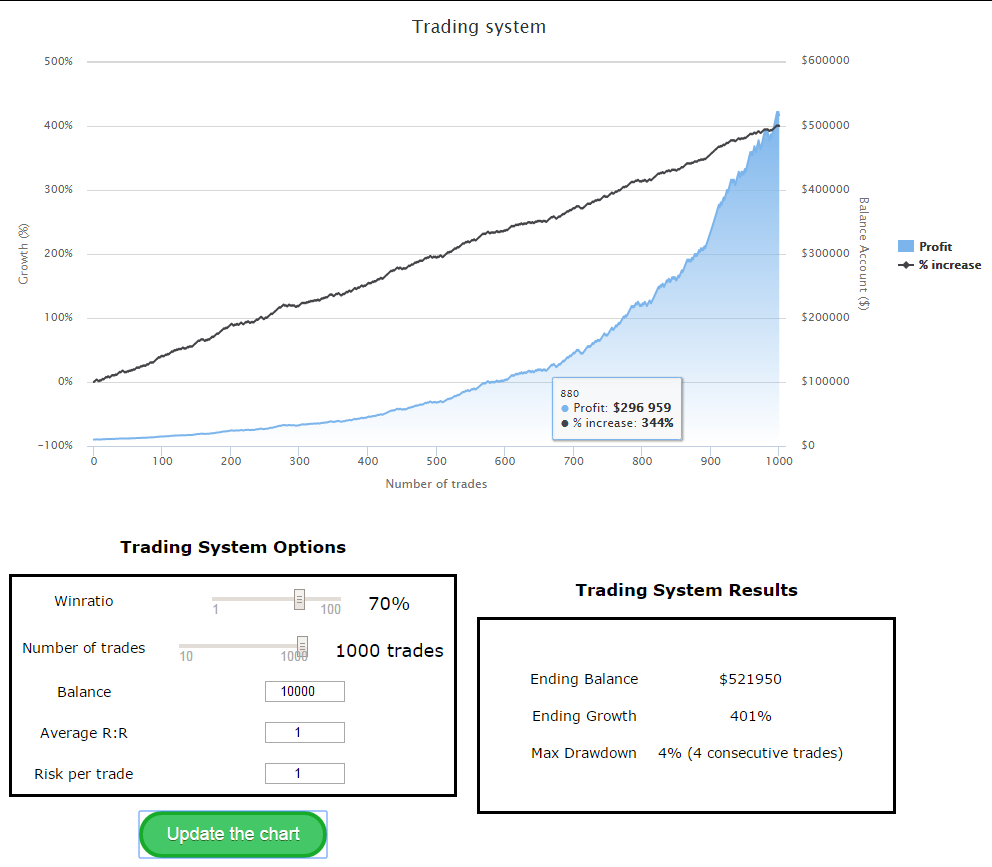

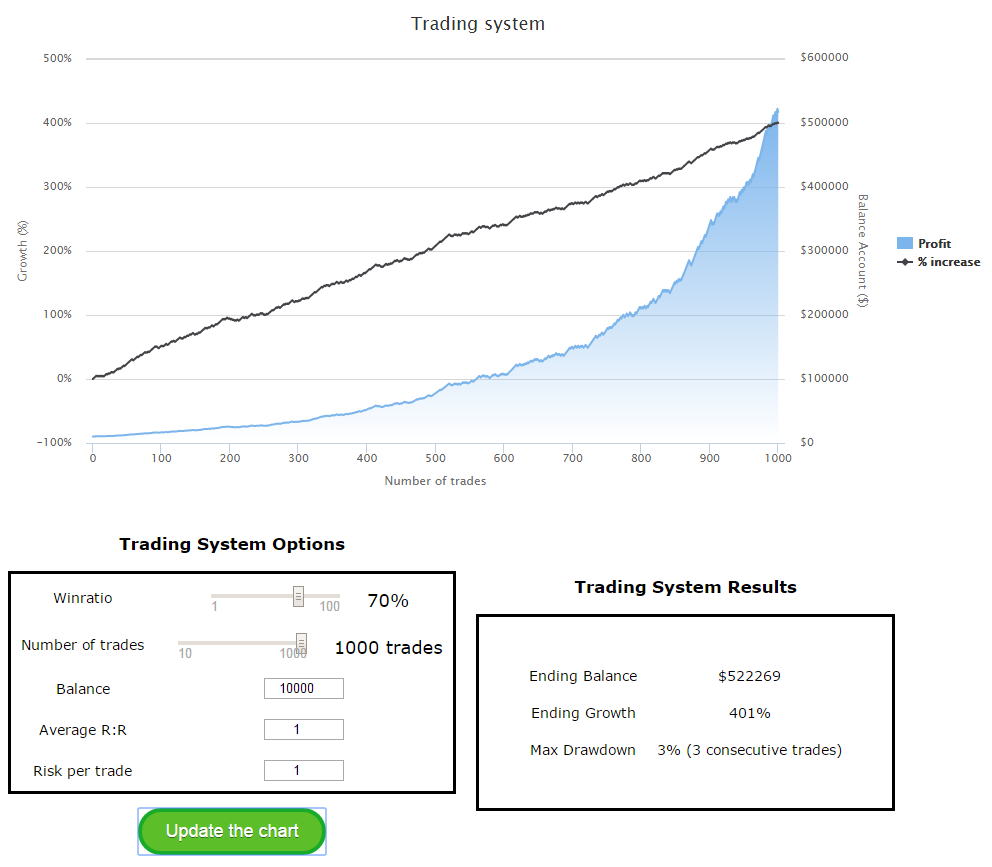

I suggest you to use the exact same parameters and click on the “Update the chart” button several times. You’ll see that the earned amount of money is the same, the performance will be the same, the ending balance will be almost the same. Here are some examples :

All is almost the same : the goal is the same. The only difference is the path you took to reach it.

The trading (from the technical point of view) is just a matter of statistics and probabilities. That’s all. You can have an edge over the time but you will never be able to choose this path and to control the randomness of your losing streak.

How will you react when you will be in trouble ?

This was the technical point of view. Easy to understand. Now, we can enter the funny psychological world.

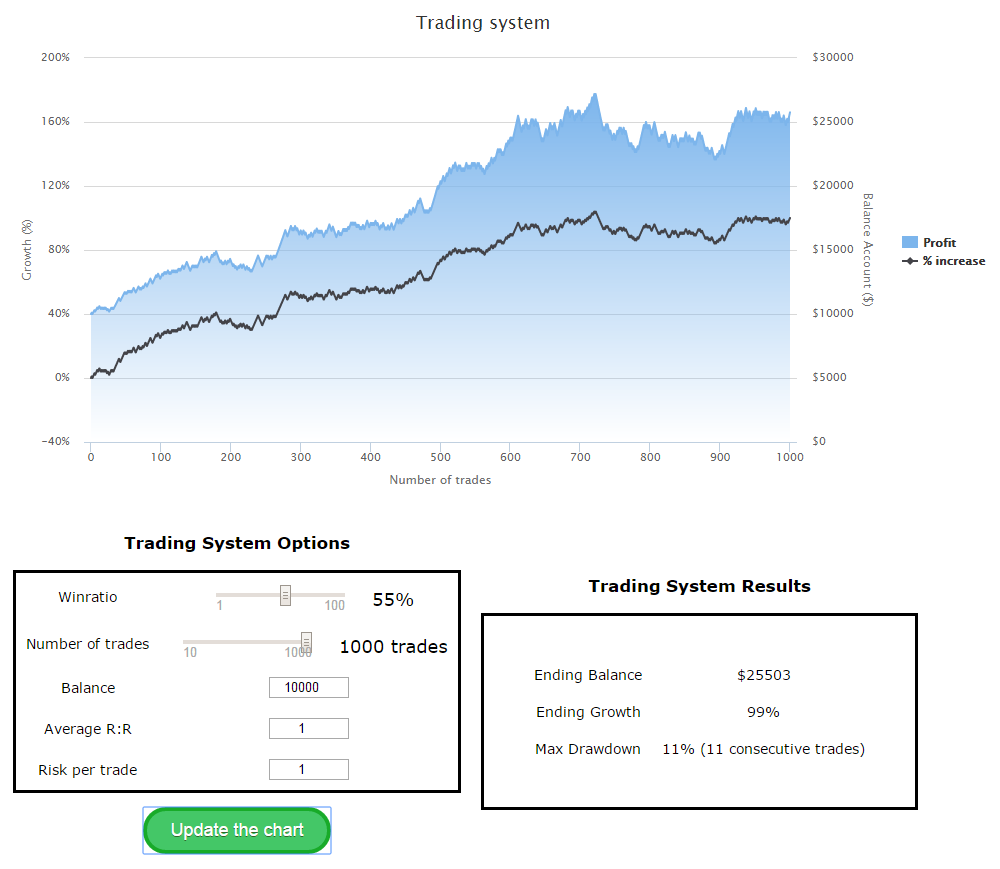

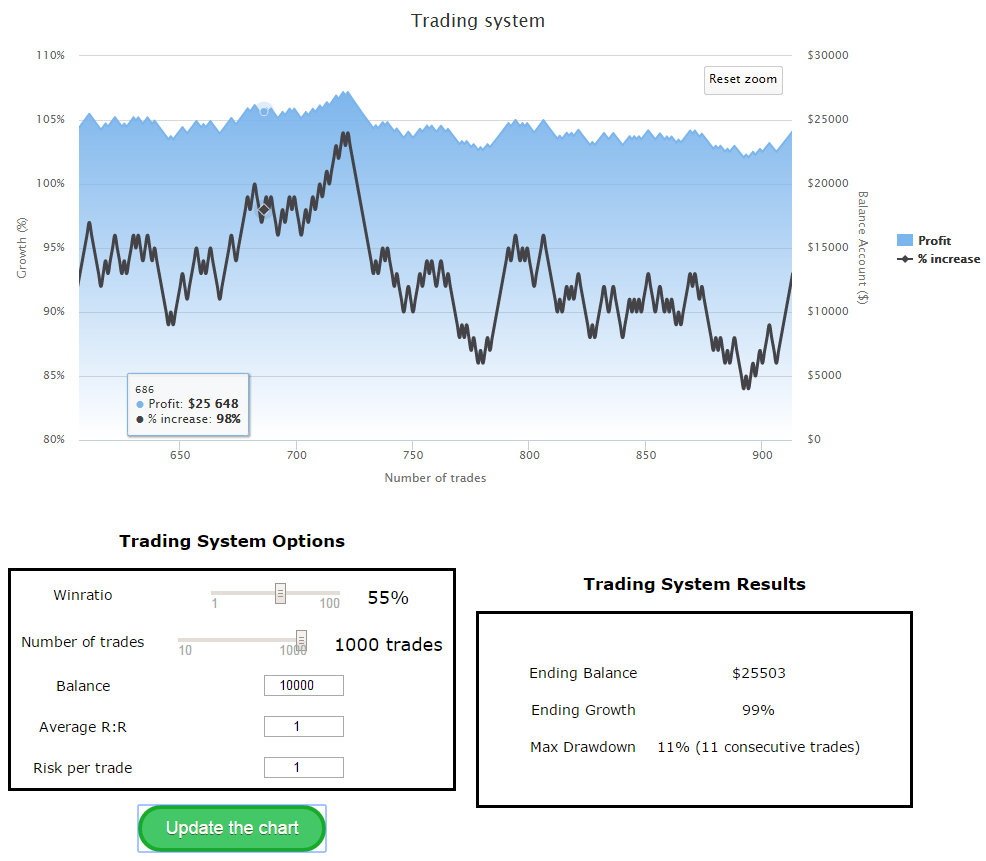

For information, the characteristics of the previous system are interesting and not often seen in the wild Forex world. Relating to the so-called social trading network website, the winratio is often more close to 50%-60%. Again, we can take this amazing, homemade and ugly tool which is my Drawdown simulator:

After 1000 trades, our 55% winratio trading system met a 11% drawdown period. It’s not so much higher than before. But if you launch the “Update the chart” button, you will understand that with this kind of system, you are really more likely to meet such big drawdown than with the previous system.

After 1000 trades, our 55% winratio trading system met a 11% drawdown period. It’s not so much higher than before. But if you launch the “Update the chart” button, you will understand that with this kind of system, you are really more likely to meet such big drawdown than with the previous system.

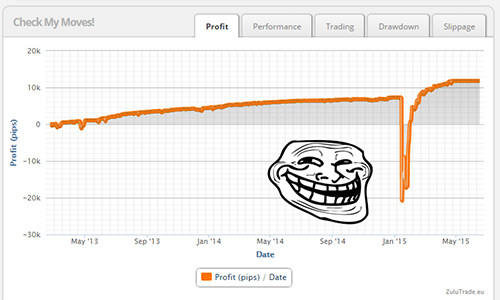

But what’s interesting here is not this absolute Max Drawdown numbers but the curve above it. We can notice the stagnancy (even loss) of the performance during a long period of time. Between the 600th and 900th trades, almost no money is done. In fact money is even lost. We can zoom in to view it :

A period of time of 300 trades is very long in trading time. Depending of the trade frequency property of your trading system it can be seen as the eternity. This curve is very ugly because the income is just ranging. That’s the fault of the low winratio.

Beyond these technical considerations, the main issue is the following : what will you do when you will be in this period of time ? Will you stick to your trading plan ? Will you stick to your trading system without changing anything ?

The most likely answer is that you will have serious doubts on your confidence and your system when you will reach the 300th gambling trade. The chances are that you will change your system with different and inappropriate properties in this drawdown period of time.

I let the average R:R to 1:1 in this example for the demonstration but for information this kind of system is likely to do something more close to 1:2 or 1:3 (pretty rare with this winratio). This is the case for most of the so-called Trend following trading systems. You can have big winner trades but sooooo long period of drawdowns. It’s not a kind of system for everybody for sure.

As a professional trader, I know it’s impossible for me to endure such big drawdowns. So now, if you want to become a true successful and profesionnal trader, earning money consistently, you have to answer this critical question : How much drawdown can you endure ?

Your first step to achieve in the trading world : being comfortable with your trading system. Answering honestly this question will bring you this.

I answered this question few years ago. I know I can’t bear a drawdown more than 10-12%. Knowing that I built my system in accordance with it.

Great articles!

From your experiences and based on your trading edge, R:R 1:1 works better for you (for trading performance and low Drawdown periods) than usual trend-following programs where you want to hit big winners on long term?

thanks

Ann

Thanks Anna,

In fact, in trading you have to choose sides : if you want a good winratio, then you’ll have a low average R:R. But if you want a high average R:R (something like 3:1 for example), then you’ll have a poor winratio. You can’t have both. There are few ways to reach some kind of compromise, by using split management for example (using 2 positions with 2 different TP, the first on 1:1 and the second catching the big winners), however it will divide your gain and provoke a lot of break-even trades. This allows to smooth a bit the equity curve too.

Moreover, I like my average 1:1 R:R (or sometimes 2:1 when the trend is friendly) because it’s easier to handle psychologically. Like a lot of people, I prefer being right most of the time

And exiting the Market properly when you’re catching a big runner is not an easy task

Got it. Thank you Beta for explanation. you re very humble i like it.

thanks

ANN