When I started this blog I never imagined that I could ever write an article on the necessity to use stoploss in Forex trading. However, browsing the retail forex world is so astonishing when you see plenty of traders taking orders without stoploss. When I started to address the Forex Market and was still naive, I thought that the vast majority of traders couldn’t think one second about entering the Markets without stoploss. I thought only few of them were cowboys telling themselves the stoploss is just an inconvenience for their ego. I was wrong. It is the contrary. More retail traders are not using stoploss than using it.

I’m often amused when I look at the “signal providers” or “professional traders” equity/growth charts when they don’t use stoploss, their equity curve can be very typical. For these kind of traders, claiming themselves “pro” and wise “risk” manager, I will be happy to be the counter-part taking their money when they will margin call. Forex is not Poker.

The stoploss is an automatic order that will be triggered when the price will reach it. It’s the opposite of the TP (Take Profit) order, its alter ego. The stoploss is created in order to protect your money, to manage your risk. But you have no obligation to use it, you can take a position without any stoploss. It can be seen as an annoying thing preventing your trade to reach its target. Because if the price reaches your stoploss before reaching your target, you lose money ! Shit ! I don’t want to lose money ! I’m here to make money,.. the stoploss is bullshit !

You can have this standpoint when you’re not able to see further than the tip of your nose. Because, in the hard real Forex world, you can’t earn money consistently without losing a bit of money sometimes. It’s like that and it’s perfectly normal if you think about it 2 seconds. It cannot be different. But we have to ask ourself why the stoploss is not an option to earn money on the Markets over the long run ?

Why using stoplosses on the Market o_O’ ?

Because ! …thanks for reading this article…

There are few reasons why the stoploss is so important on the Market and we will see that it’s way more than a simple contrary order to your position.

1°) The Stoploss defines the frame of your trading system

It’s important to understand that every trading system is technically nothing more than a basic probabilistic system. Technically of course. Because, in practice, successful trading is just about solving your psychologicals bias. So, technically your trading system can be seen as a probabilistic system with standard parameters.

Your trading strategy is defined by a set of rules which you follow (or not) and it creates a trade history. You will have winning trades and losing trades. You can say you are profitable when there is more money on your account before you started to trade during the period you analyze. Depending on your trading style, you can have a lot of trades per month, a lot of winners or a lot of losers. But what’s universal here is that you will have winners AND losers. You can’t avoid losing trades, that’s impossible.

Now the question is : what is the definition of a winning trade and a losing trade ?

We could simply argue that a winning trade is a position where you make money and a losing trade is a position where you lose money. The problem with this kind of definition is that your losing and winning concepts will vary and change over the time. It’s too generic. If you think about it, a trade that went well and was in profit during some time can reverse and become a loser. When will you decide then it will be a winner or a loser ? It will depend on you, when you take the decision to cut the trade. For one single trade, depending on your mood, your behavior, your psychology, the same trade can be a winner or a loser. It’s a problem. Be sure that the human psychology is a very changing thing. How can you assess the profitability of a system if you change the winning and losing concepts all the time ? How can you calculate the expectancy of a system by changing the winning and losing rules all the time ? Can you know if you earn money on the Market if you don’t know if it’s a losing position ?

To become successful, we have to avoid relying on changing and varying things like us. We have to set the rules and the system has to be as steady as possible to evaluate the risks properly. Here comes the stoploss.

The stoploss will help you to set the losing trade concept without changing the rules. By setting your stoploss on every trade, you know exactly when your trade is a loser one : when the stoploss is hit. From there, you will be able to assess the expectancy and the profitability of a trading system because you defined the “loss” concept relating to the “win” concept. Otherwise, good luck ![]()

2°) The Stoploss is designed to manage your risk

As described before, trading is a probabilistic game. When you take a position on the Markets, you bet on the future value of an asset. It’s pure speculation. Your trading style and system will dictate you how many trades you can take every month and for every trade you have to calculate the risk implied. You cannot avoid it. Even if you don’t want to do it, the lotsize of your position will do it for you. As said before, you know as a wise trader that you will have systematically losing trades in your track record.

If don’t use stoplosses when you take a trade, you cannot know how many you will lose. This is financial Markets world. It’s not about dealing sweets during recreation. When you enter the Market you NEVER know what will happen. You have to expect always the worst-case scenario. What if you take a position without stoploss and the Market will go instantaneously against you ? When will you cut the trade to accept your loss ? Will you accept the loss ?

Entering the market without stoploss is like “all-in” in Poker. You risk all your capital on a single one position. It’s good if you win but it’s pretty ugly if you lose. Like the Poker, it’s all about probabilities. You can make a good move if you are lucky but it’s impossible to think about making money over the long run with this kind of standpoint. You can earn a lot of money in the short-term but one day, you will lose all your money. It’s useless to earn a lot of money to lose it all few days after. Being a wise risk manager, as every trader is, and risking all your money and the money of your clients on one single position doesn’t make sense at all.

Using a stoploss on every trade allows you to expect the worst and manage the risk on the Markets. Then, you can calculate the risk you want to take on each trade in case the price will reach your stoploss before your take profit.

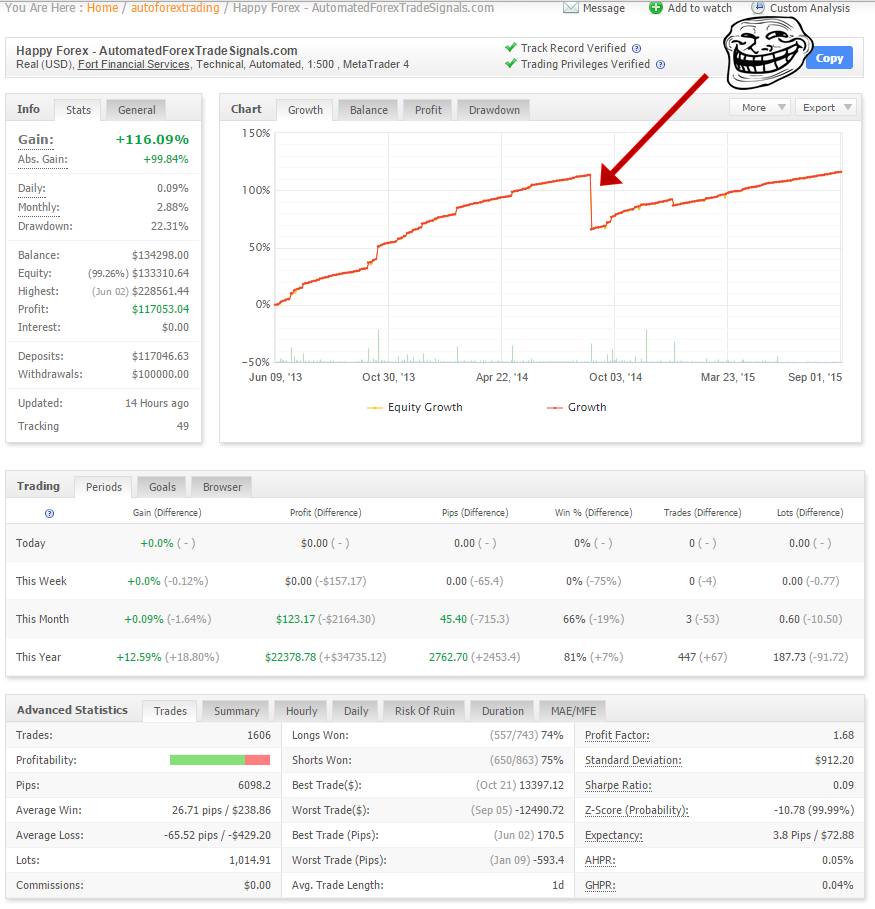

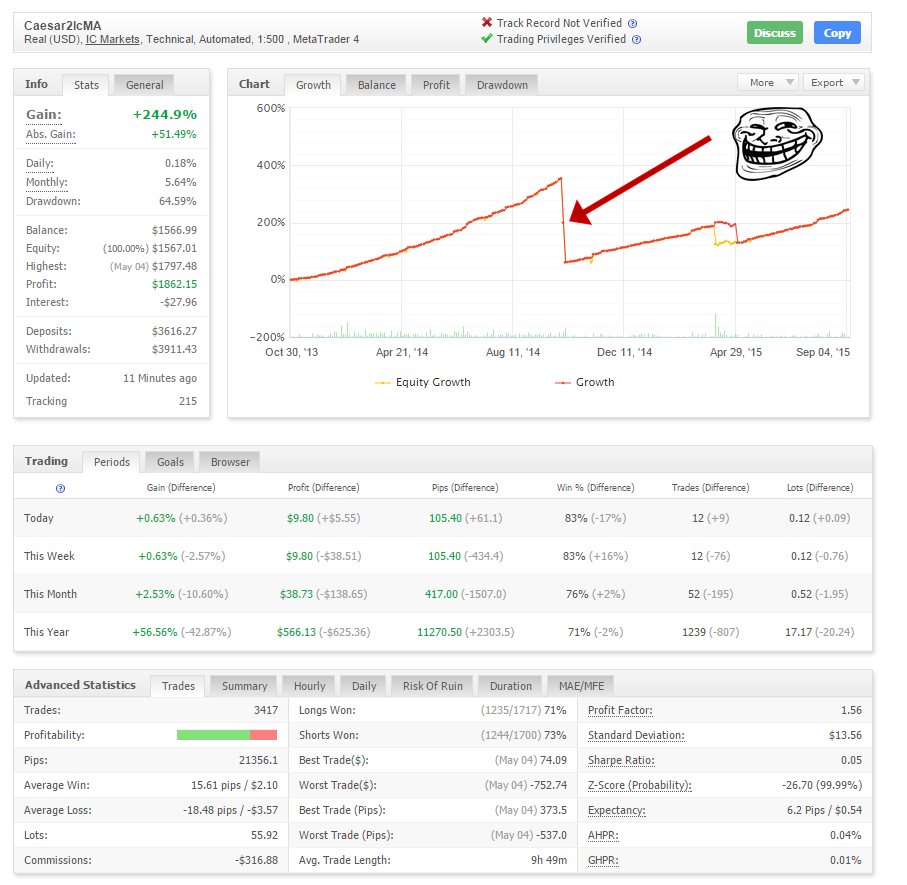

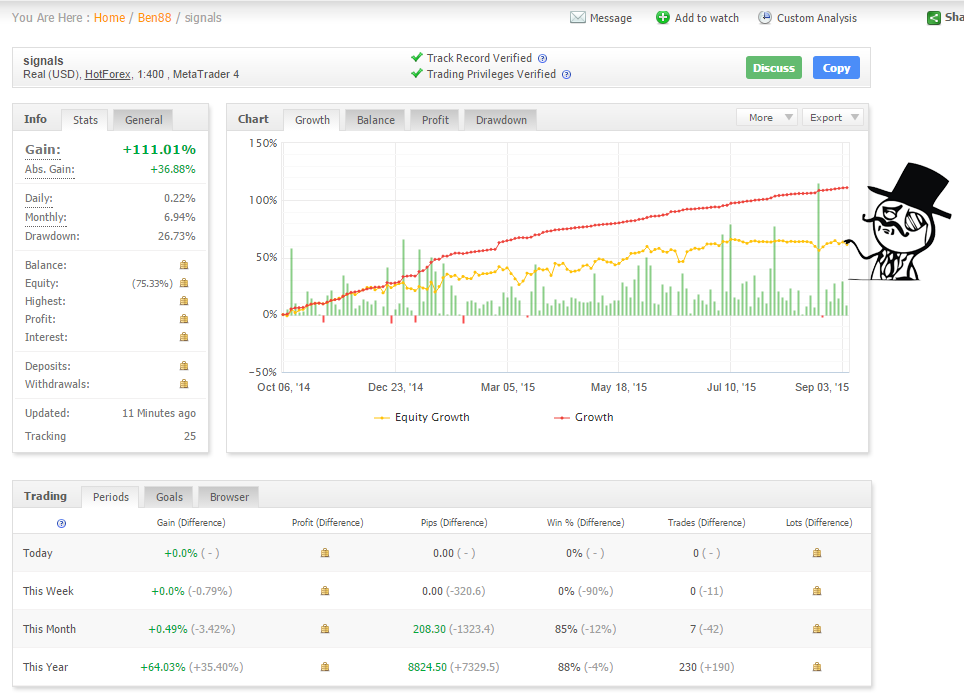

A lot of so-called “pro” traders charts are screaming the use of the “Russian roulette” trading style by not using stoploss on every trade. It’s pretty distinctive. I chose some myfxbook charts almost randomly :

We can never have the proof that these guys don’t use stoplosses just by staring at their chart but the “tobbogan” is really typical of this kind of system. These systems have often really high winratio, as seen in the last example. It can be explained easily by understanding that these dangerous systems are likely to not use stoplosses and letting the position run until the Price go in favor of the “trader”. That’s why the winratio is so high. However, sometimes the Market do some erratic movements and go against the position. The “worst-case scenario”. One day, the trader has the obligation to close the position if he doesn’t want to margin call. So it’s a huge lost of the entire capital in 1 or 2 trades. You could argue that overall these systems made money. You are right. But as usual, what if you used this system to trade your money just before the drawdown ? What if you see your capital going down for 60% ? You would have left and probably you would have lost a lot of money. And I don’t talk about the equity curves this time. The margin call is a matter of time.

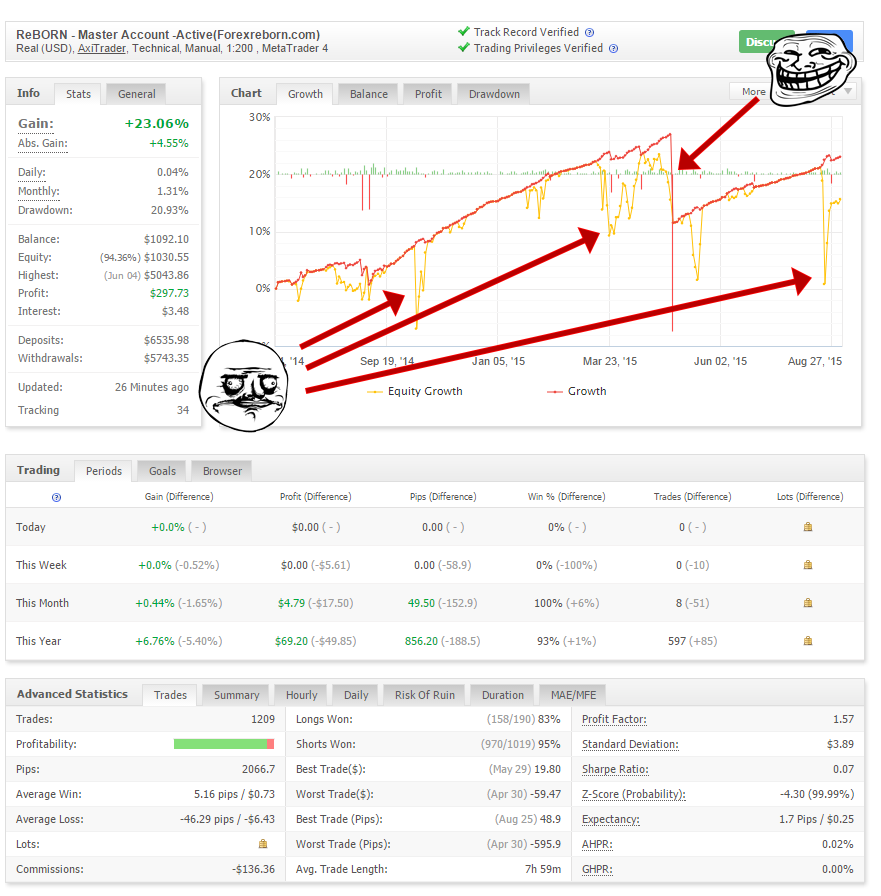

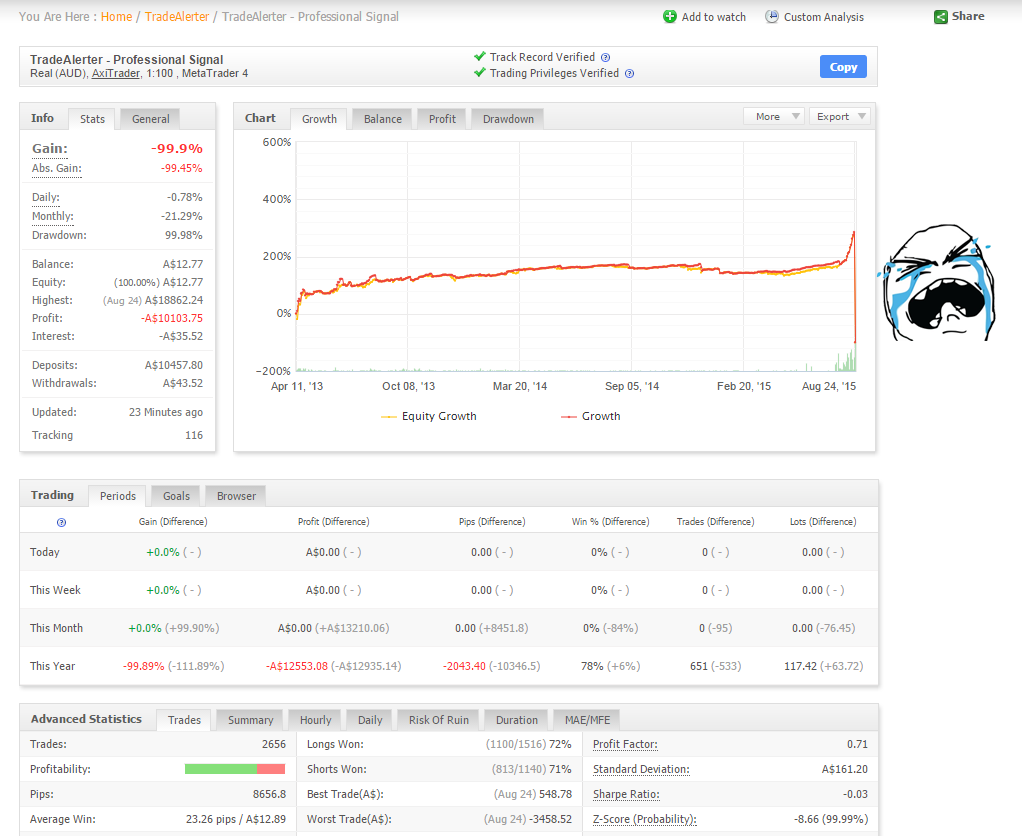

Another typical “I don’t know what is a SL” trading style chart is the “floating” open positions. You can see that the equity curve and the growth curve hate each other :

It’s due to the same root problem : the trader doesn’t accept to lose money. He thinks the Market is wrong and its trading is right. He is convinced that the Market will reverse soon so he lets its current positions floating without using stoplosses. Until one day :

Always expect the worst when you enter the Market. Use stoploss to protect your capital.

I already talked with people telling me that stoplosses are useful but we have no guarantee that our broker will honor them in very volatile conditions. It can be true. During the SNB earthquake in January, some brokers were not able to execute all the stoplosses. But it’s another issue relating to the Market structure and the broker itself with its liquidity providers. I doesn’t dispense you to set a stoploss for each trade you take.

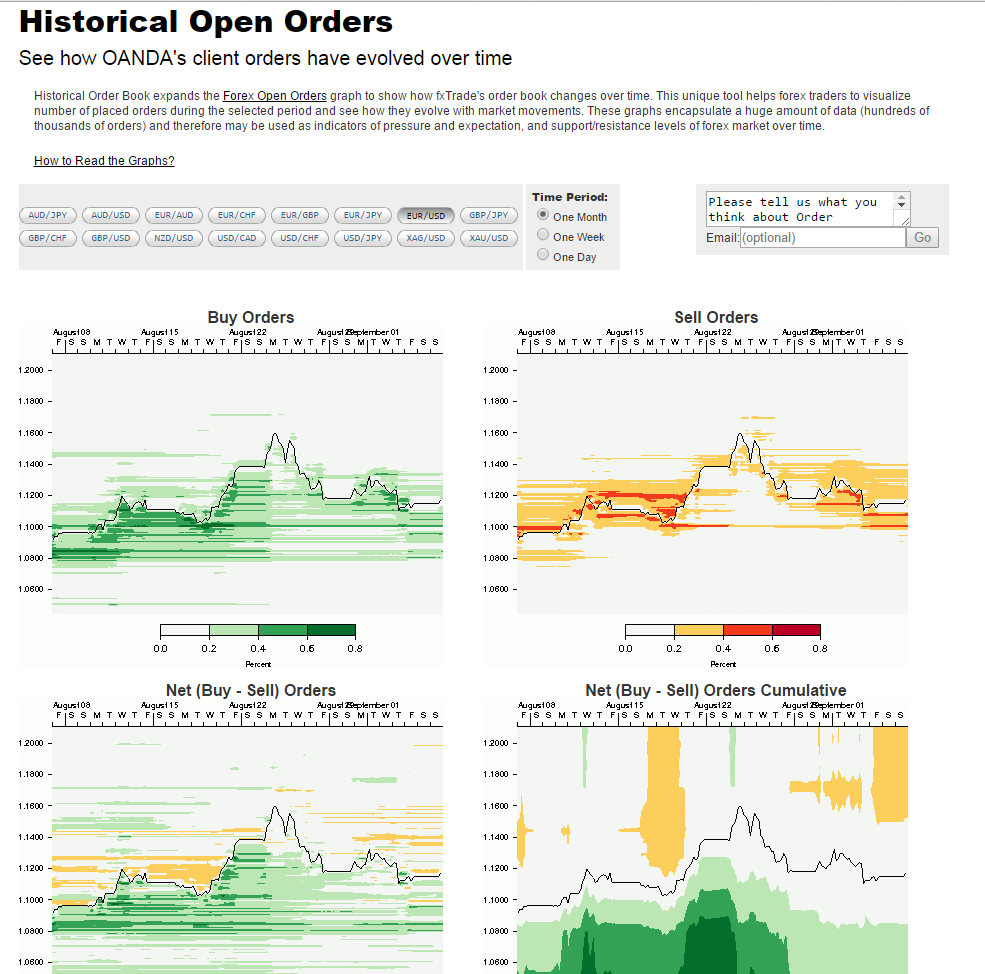

Moreover, as a swing trader, you have to know that your stoploss orders are more likely to be honored (in comparison to the intraday traders using minors S/R levels) because your stoploss is really likely to be in big order clusters which improve the probability for them to be triggered, even during this kind of extreme volatility periods. For information, you can see here that the location of the big order clusters are often where we put our stoploss :

3°) The Stoploss symbolizes your loss acceptance

The last but not the least. Don’t forget that the psychological aspect is the main issue to become a profitable trader over the long run. In the early stages of your trading journey, you’ll have to accept the Market is always right and you will be wrong sometimes. It’s not necessarily because you did mistakes but because you have to lose a bit of money to earn more money. The stoploss is here to tell you that in case the price triggered it you lost money but you protected your capital. It’s a loss. You have to deal with it. Accept the loss to earn money over the long run.

Moving a Stoploss during a live trade highlights your difficulty to deal with the losses, when you widen it. Moving a stoploss is like not using a stoploss. You increase the initial risk of your trade, which is a statistical error. Never move your stoploss once it’s set. Except to put it on break-even.

To conclude, here is an interesting podcast of Walter Peters. I advise you to listen these 2 true pro-traders speaking about stoploss : http://www.2traderspodcast.com/podcast/ep04-what-goes-into-setting-your-stop-loss

Another interesting quote from Rolf of Tradeciety :

A stop loss is like a seatbelt. You don’t expect to need it every time you get in a car, but when you need it, it’s there.

— Tradeciety (@Tradeciety) 29 Juillet 2015

So many helpful articles. I was searching for an article such as this one. I have been put it on my bookmarks bar.

Thank you for your sharing important information.

and nice blog site.