Trying to become a true profitable trader and building your own trading system is a long and tedious journey. You will have tough periods climbing sloping mountains of doubts and fighting the wild psychological bias hidden in the bushes all along your travel. The obstacles on the path to victory are diversified and one of them can be very odorous : the scam. You will have to avoid to walk on it like dog poops.

Here’s a little article to help the investor and the rookie trader to detect and avoid them. You can use it on the track records you can see on every trading websites. This is a very simple scoring system where the 0 lets assume that the system is reliable and the 10 tells you to run away from the trading system.

Later, I’ll do an article to use efficiently the scamometer on trading websites.

We will start with a scamo-score of 0 and we will add points progressively trying to detect the best dog poops in the retail trading landscapes.

The drawdowns

When you see a bleeding equity curve, you can ask yourself how the trader is managing the risk… Does he use stoplosses ? Does he hedges ? Does he keep positions opened during long time ? Does he accept the losses ? Does he like unicorns ?

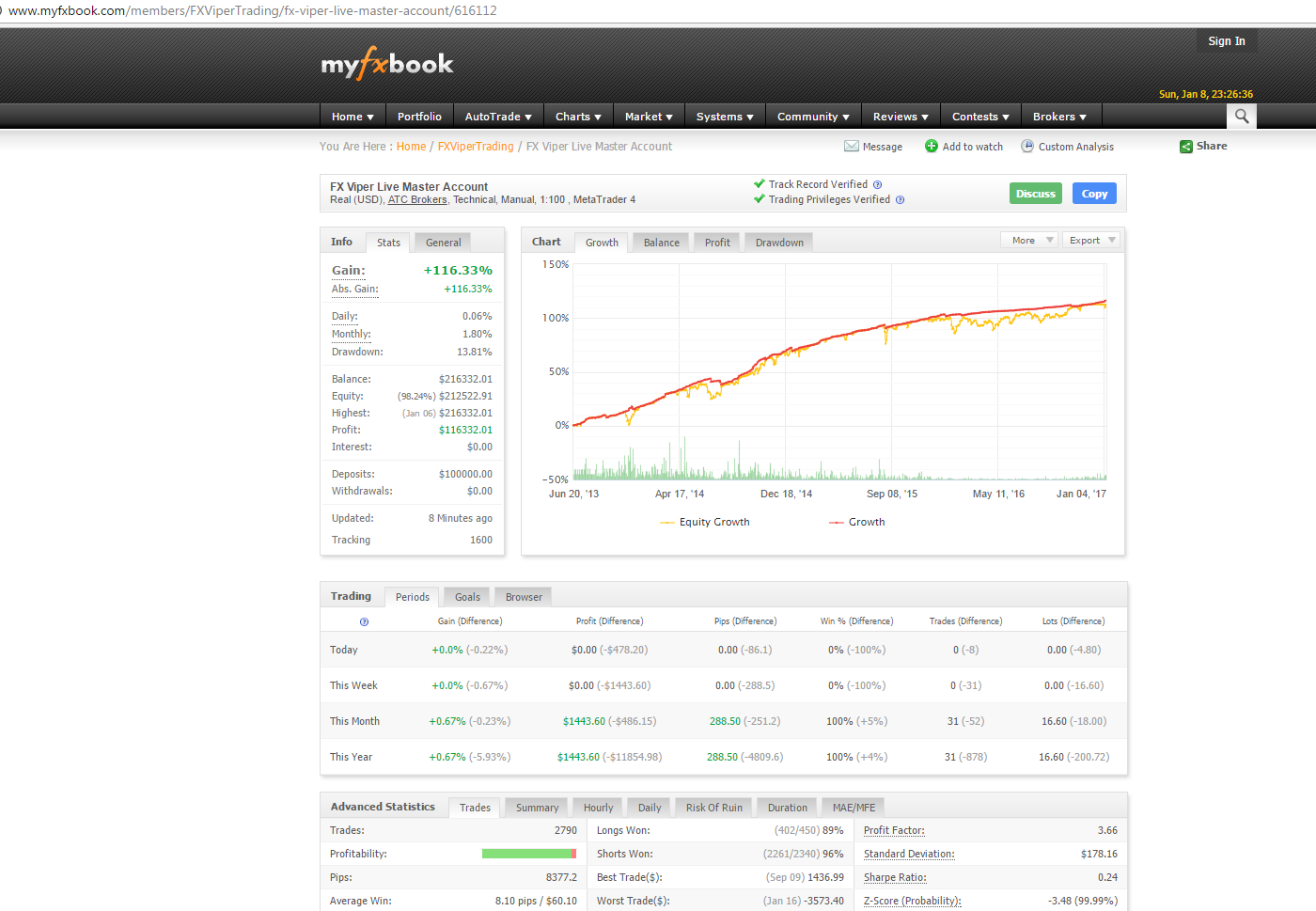

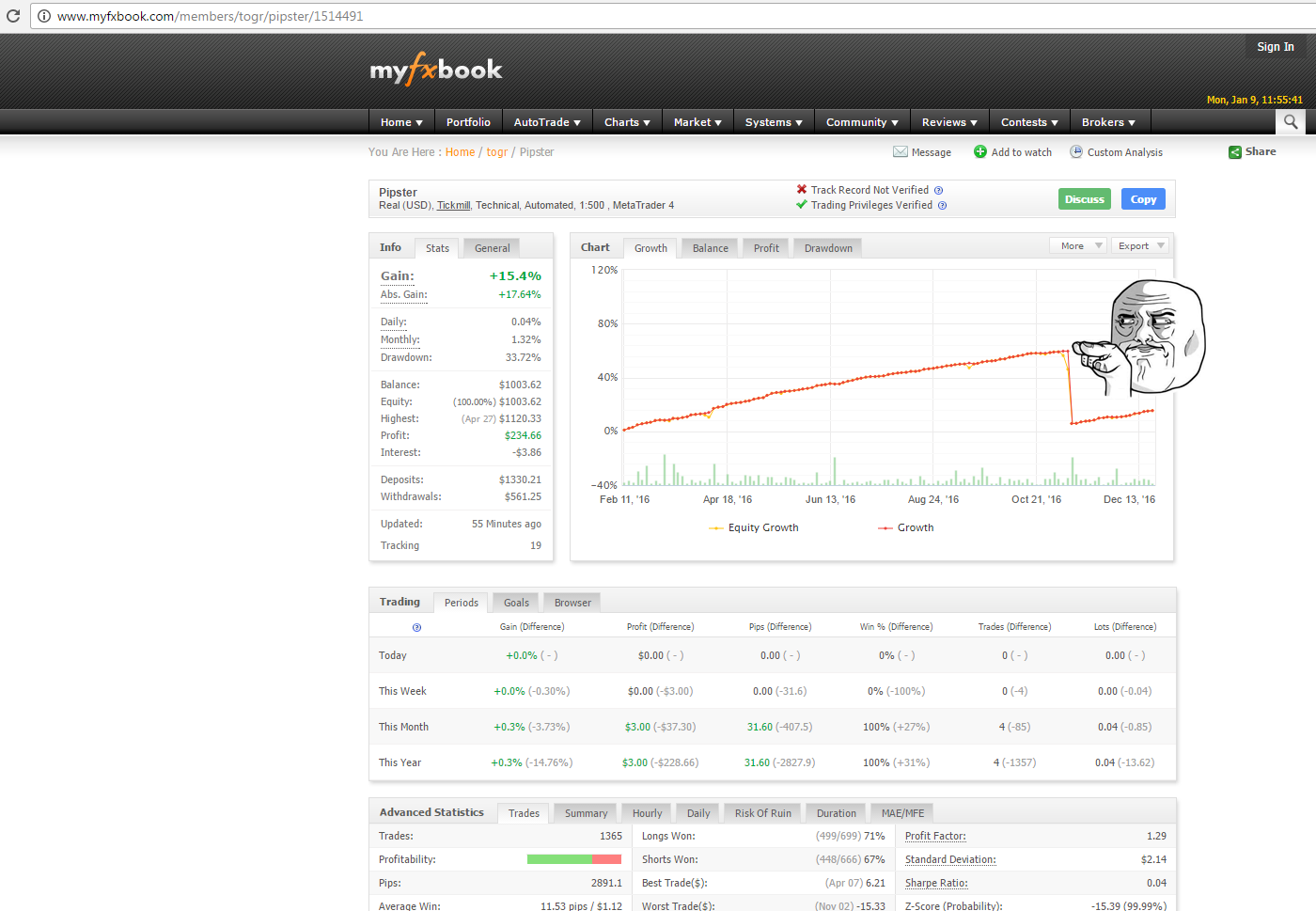

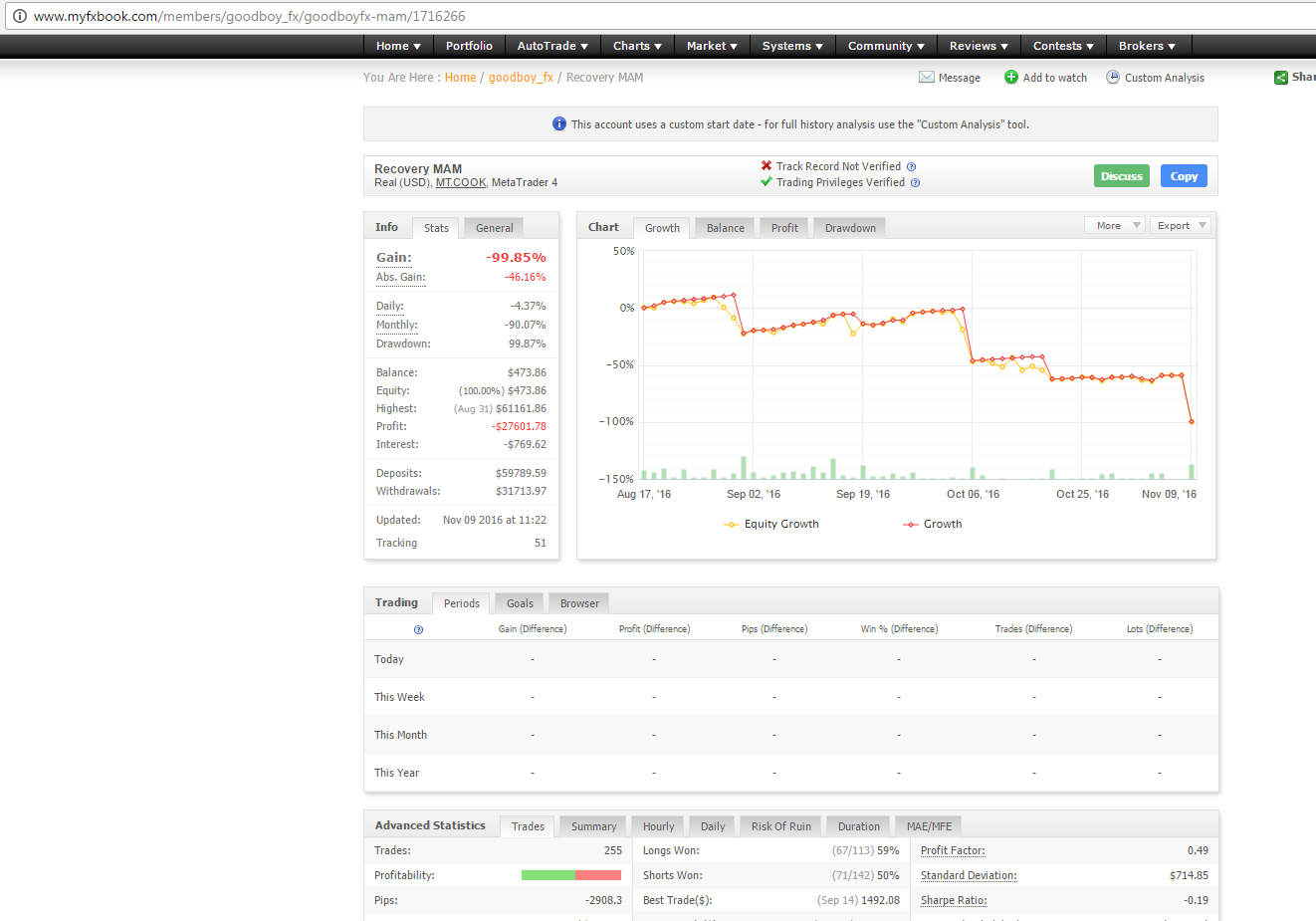

By seeing bleeding equity curve, you can add a +4 to the scamometer. I chose arbitrarily the most popular system on the Myfxbook website. The equity bleeds like an investor cutting his wrists:

The curve look

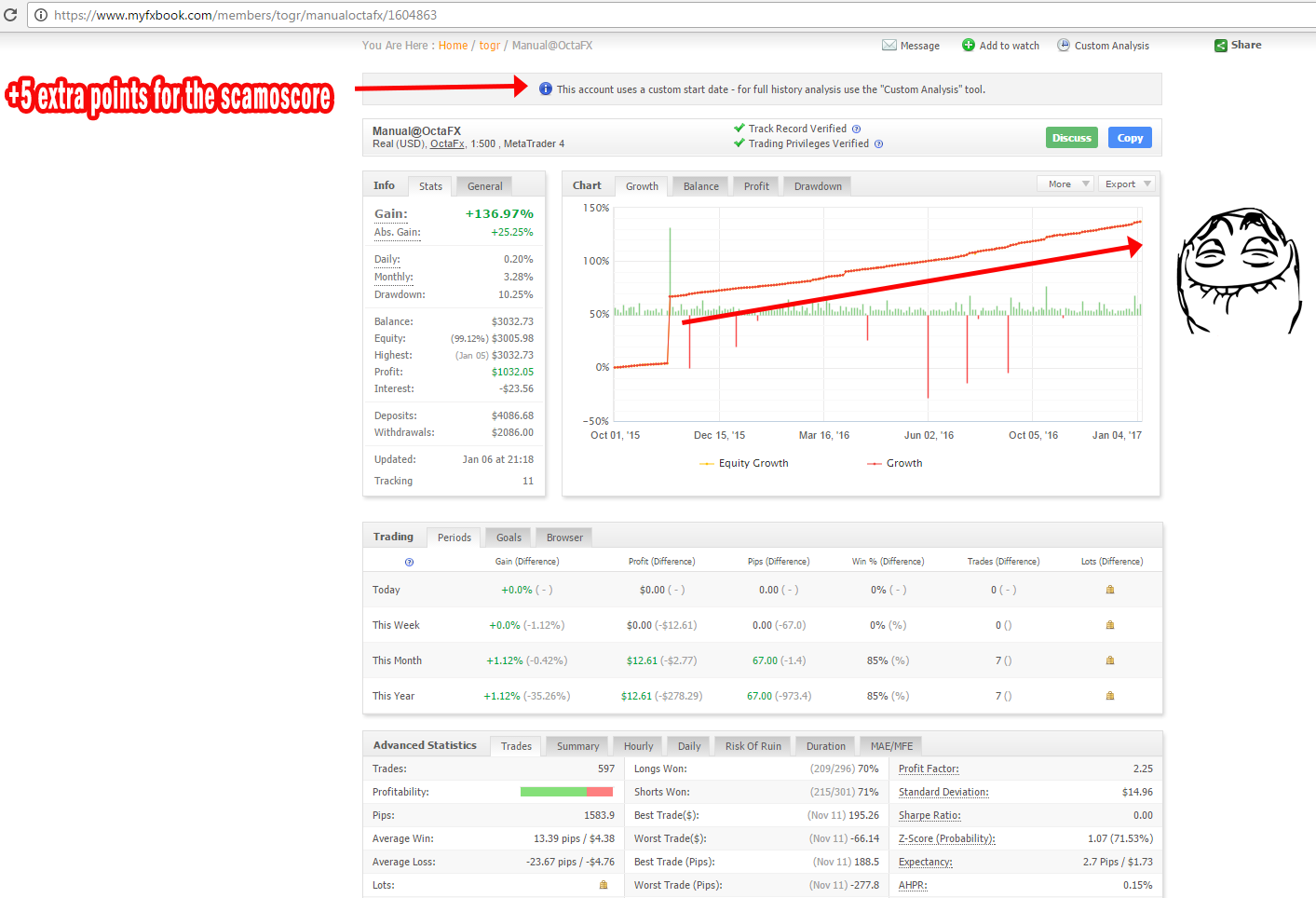

When the growth curve is very sexy, appealing and hot, just like a linear curve, you can worry. Indeed, the track record shows in this case that the pseudo “trader” doesn’t accept the losses and is very likely not using stoplosses. This is very typical of the Martingale/Grids systems.

Give yourself a favor and add a nice 6 points to your scamometer when you see this :

Sorry guys, the progression of a profitable system equity curve is never linear. Over the time, you’ll see this kind of thing (this other system is from the same scam-author than the previous one) :

The ratios

The CRR (Chance/Risk Ratio) is a simple but efficient ratio calculated by dividing the percentage growth by the drawdowns. Thus, you have a quick estimate of risk and potential of the trading system. You can calculate it on a montly, yearly or historic basis to notice the evolution and the risk mitigation of the trader.

If the CRR is lesser than 1, you have a failing trading system in progress. This is cute to see. You can easily add a +2 to your scamo-score.

If the CRR is above 1, you have some kind of flat expectancy system but you have to confirm it with other metrics. This is quite neutral.

If the CRR is above 2-3, you start to see a decent trading system making money in theory. Again, you have to confirm this with other metrics.

The system vocabulory

When you assess a trading system, you have to read a short description to sum up the trading style of the trader (swing/scalper, fundamental/technical, …). The scamometer can detect some keywords in order to warn the investor against the shittiest systems. Here a sample of the interesting keywords :

- Martingale : This keyword is pretty magic. If you want to assess a system based on Martingale, you can directly put your scamoscore to 10 and forget all other criteria. You found the bullshit holy grail. If you are bored, watch the system over the time, let it explode, this is always funny and some kind of relaxing to see. This is less funny for the investors/traders.

- Grid : The grid is the cousin of the Martingale. Different phylosophy, same result. It’s designed to fail but it’s a bit more vicious. The Martingale has often a low life expectancy but the Grid can live longer before blowing up your account. But it will. The risk exposure of this kind of system can be huge and the risk control is almost always none.

- Full automated trading system : This one means that there is only a dumb robot taking trades on the Markets. This robot is so smart that he knows better than a human how the Markets behave. Is it possible that a simple EA trade efficiently the Markets over the long run ? The markets are so easy to corner ? Hundreds lines of code can beat the other market actors ? Even if the deep learning concepts could improve the Markets insight in the IT field, you can safely add a +4 when you see a 100% automated trading system. If the trader uses a “mix” of manual and automated trading, the scamometer could significantly decrease its BS detection process depending on the trader style.

- Custom/Proprietary indicator : This is a trading system using a very top secret confidential indicator created by the trader. He was lucky (or smart ?) enough to find the Holy Grail. This is only owned by the creator and he doesn’t want to share its secrets because, you know, if he does, he will lose its hedge on the Markets… Of course trading holy grails don’t exist… No custom/proprietary indicator can corner the Markets. And you can ask yourself what would happen if one day a trader discover the Holy grail ? How will the Markets behave ? Even if you can create nice custom indicators, it will always be derivated from the unique raw information : the Price Action. Save time : use the raw information instead of derivated ones.

Using the prefix “pseudo” before the 2 first keywords doesn’t change the score calculation.

But sometimes, the lack of certain keywords can increase drastically the scamoscore. For example, if you don’t find any information about stoplosses and you know that it’s some kind of UFO concept for the trader, you can add a nice +9 to the overall score. This remark can be moderated by the fact that instead of using stoplosses, true profitable traders can use hedging. However this is very specific, hard, and complex skills to master. The number of true profitable traders using successfully the hedging instead of the stoploss is equal to the number of finger on a hand of an armless person.

The trader beliefs

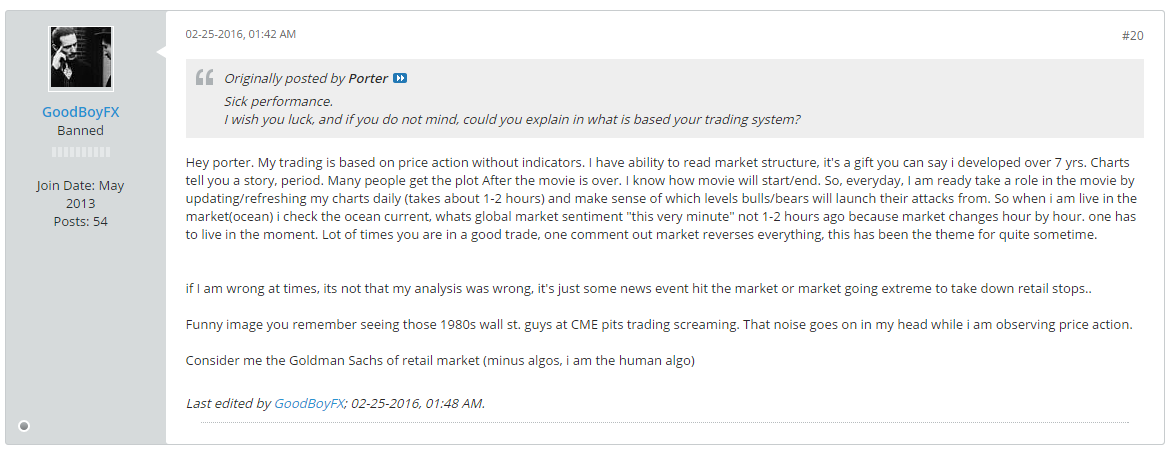

This is very important to identify how the trader sees the Markets and the risks associated. Its behavior and words are important too. You’ll find some “traders” being arrogant, proud and pretentious. All the true profitable traders I know have a common quality : they are humble. And on the Forex you have to be humble. You have to respect the Markets. Once you ended your journey by trading a profitable system, you become necessarily humble because of all the dusts you bit before achieving your goal.

Here’s a funny story of a scam-trader offering its signal service on some signal forum community few months ago. You can see the bunch of common and basic psychological bias he had and its amateurism :

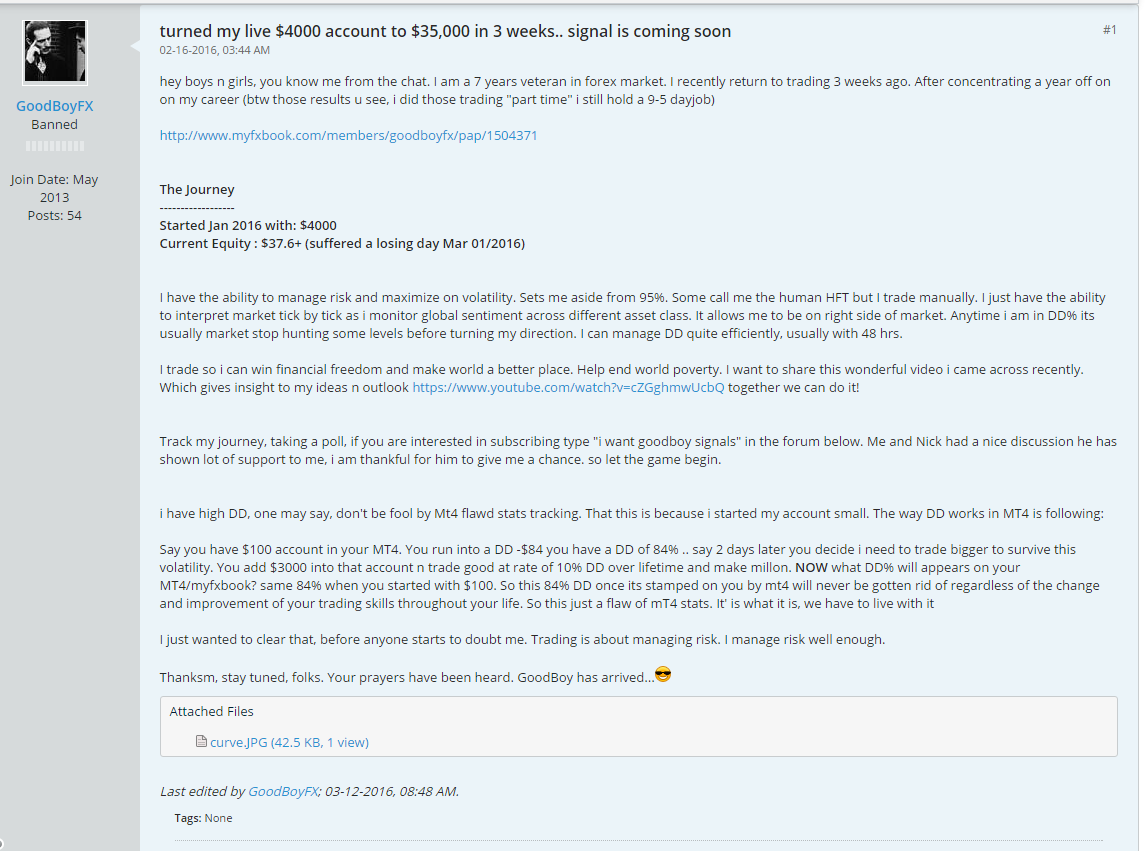

I don’t even talk about the huge and so risky performance he had. You can see the wizard explaining that he has a “gift” being able to know where the Markets will move :

He self claimed being the the “Goldman Sachs” of retail market. Such a gem. This one comes back regularly on the rookie traders forums. A lot of people want to trade for JPMorgan or Goldman Sachs banks. It looks like this is the edge of the trader carreer. But you can trust me, when you are a successful profitable and independant trader, you certainly don’t want to trade for these intitutions.

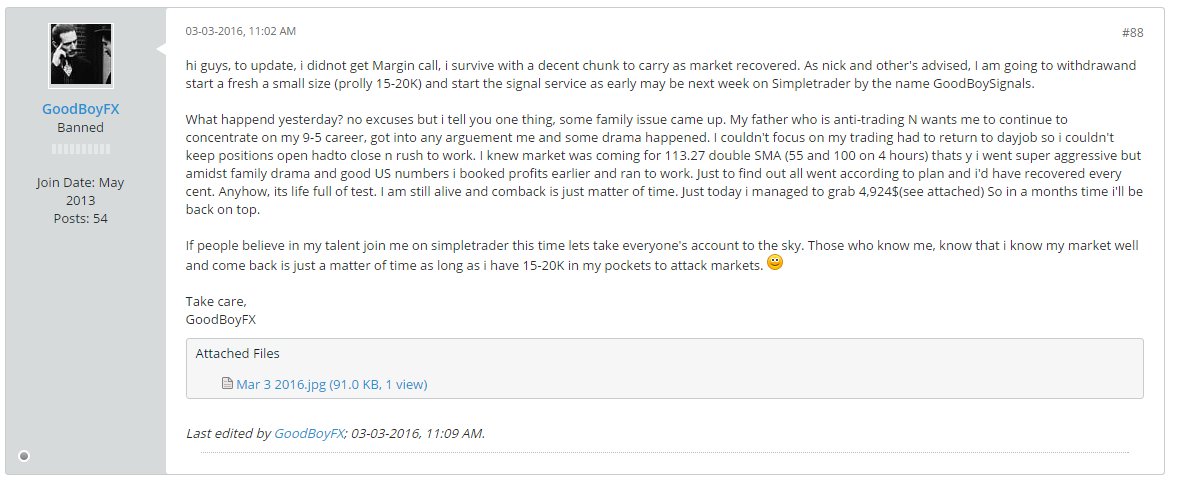

When some non expecting events occured, the “trader” finds excuses (very common psychological bias when you start trading is to not undertake your own responsabilities) :

How this has ended ? With a lovely margin-call of course:

End of story. End of trader/investors money.

The winratio

This rule is very easy to understand. If you find a system with a overall winratio higher than 90%, you can add +6 to your scamoscore.

Otherwise, it depends on the trading style of the system and especially the expectancy of the system. Considering a winratio without taking in account the R:R doesn’t make any sense.

The lifespan

Again, it’s a very simple and obvious rule to follow :

- Less than 3 months of track record, you can add 5 points to your scamometer.

- Less than 6 months of track record, you can add 4 points to your scamometer.

- Then, you can decrease by 1 point every 3 additional months.

The backtest results are not considered by the scamometer. Backtest and demo trading are nothing compared to the real live trading.

Abracadabra !

By applying these weird and empirical calculation rules, you’ll have to say “Good bye” to your money in the future if the overall scamoscore is above 10.

Abracadabra… And it’s gone !

FX Viper is good trader he make money and trade investors money. If you trade small lots size you dont need stop loss. Open loss is same like hard stop loss. If market kick you 5-10x time you lost money too (with 2% risk per trade = 10 – 20% hard DD). But open loss is possible close to BE or in profit ..of course in future. Viper is good example he make 117% profit and maximal DD he has only 13% on this account = very good Risk Reward Ratio. You have only 1:1 but if your system fails you lost money because is technical system. This is not edge every entry is same. Chance to win or loose is always 50% specially on Forex market. You open few trades in year…you have just luck. Why you have hidden balances and trade size ?? I quess you have 100 $ on trading account and try sell forex signals ?

Finally I have a divergent comment, I’m happy

But thanks for avoiding doing such statements when you absolutely don’t know what you’re talking about.

By saying “Open loss is same like hard stop loss”, you obviously don’t know the meaning of “stop loss”. Not accepting a loss is the first and easiest psychological bias to fight against. The ABC. ?

?

My little finger tells me that FX Viper is not very involved in the serious institutional world. There is a reason. In this kind of environment, you can’t trade without stoploss and you can’t risk the amount of money you want per trade. The ABC.

And yet, I honestly wish him success. And maybe he’s a rare trader able to master the art of hedging ?

I recommend you to read this book. Thus, you’ll see what is the concept of “expectancy” and you can use this opportunity to learn the definition of “edge” (I don’t even speak about the notion of “risk of ruin”).

About my balance, if you are able to access and browse the internet in order to comment on my website, you should be able to see it.

I give you another homework : trade a system successfully for 2-3 years without using stoplosses (it’s not so hard) and ask institutional hedge funds if they are interested in your system.

They will laugh at you. Why ? Because you missed something crucial…

But maybe are you a scam-o-master

PS : my website is not here to sell signals to the retail market (there is voluntarily no information about it on my website).

Why you deleted my comment ? With link to sell your signal ?

Once again: [moderated]

You’re a sticky troll

As I explained to you the reason by email I sent you few days ago, I don’t want to promote my signals/funds here. This is not the place. This website is not there to sell something, just to tell. I don’t want advertisement.

If you were polite you would have replied to my email little sticky troll

Ok sorry for advertisement, i read email now.

Great article, as always!

You could also add spikes of lots on the graph (on myfxbook “More–>Lots”) to scamometer. It represents grid/martingale in most cases.

By the way, FX Viper made only 5% during last year (calculated by equity) with 8.5% drawdown. Together with the heavy use of grid, low average profit/average loss, high percentage of winning trades and with no SL used this makes scamometer’s explosion worth to be seen in Michael Bay’s movies. It’s interesting that some are referring to his popularity to prove him worth investing. Millions of flies can’t be wrong!